6 best practices for getting paid

Based on: How to get paid as a freelancer

Intro: why it matters…

- Getting paid as an independent business owner is one of the most vital parts of running a successful business. But we all know it’s not enough just to get paid… Getting paid in full, on time and consistently are what really matter. And unfortunately, that’s easier said than done for many small business owners.

- According to the Freelancers Union, “71% of freelancers struggle to collect payment for work at least once in the course of their career.” When you think about chasing after late payments, getting ghosted or—worst of all—fighting disputes about whether you even deserve to be paid, it’s easy to see why getting paid gets complicated, fast.

- So what should you do to get paid on time?

Get organized.

The first thing you should do to get paid on time might surprise you. No, it’s not a secret. But it is something that separates frazzled freelancers from those rocking their cash flow.

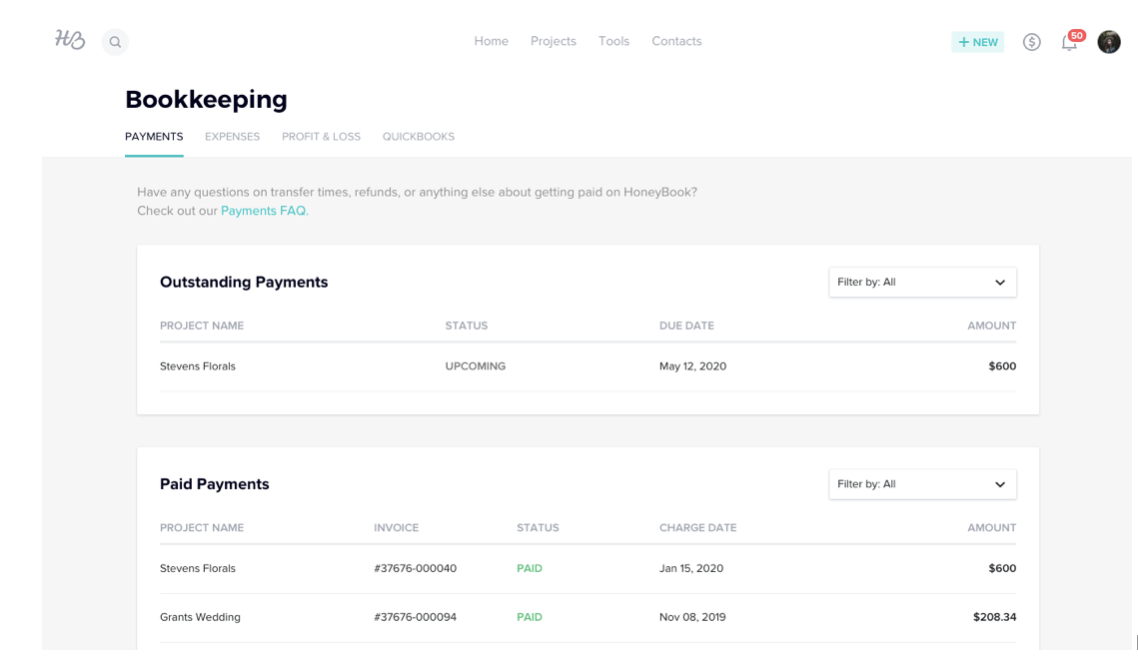

Right when we started using HoneyBook, our payments were automatically organized in one place!! This made it so easy for us to see when we were supposed to get paid, how much and by whom — it even clearly marks if someone is overdue! By having a clearer view of our finances, we were able to better understand how our business was performing and make better business decisions.HoneyBook payment tracking keeps you organized in one place.

The payment status is automatically updated in the system for you, so that you don’t need to dig through your emails and texts to figure out if you’ve been paid yet. And since you can access HoneyBook from anywhere (including on the go with the HoneyBook app), you can stay on top of your payments and feel good about your finances 24/7!!

Use a contract.

- We all enter business agreements with the best of intentions, but awkward situations can arise when deliverables and billing change. Using a contract is critical in ensuring you and your client understand exactly what you’re delivering and what to expect.

- Protect your business (and bank account) from the risk of not getting paid with a contract. It’s so easy to have your contract set up in HoneyBook, and if you don’t have one yet, HoneyBook provides legally written contract templates for you when you join!!! SO NICE! These contracts can be sent through HoneyBook for electronic signature and should be signed by your client before any work begins.

- Not only does having a contract help protect you if you need to seek legal help or escalate to small claims court, it also sets expectations on the work you’re doing, the deliverables you’re providing, when you’re delivering them and for how much. Getting this alignment from your client at the outset increases your chances of delivering work to a happy client who will pay you.

Ask for a retainer up-front.

- Collecting money upfront in the form of a non-refundable deposit before you start any work is the gold standard for how to get paid as a freelancer. How much of a deposit? It depends. A good rule of thumb is to require 33% of the project total for larger projects and 50% for smaller projects.

- Now, if asking for money makes you feel squeamish, first, stop and remember the invaluable skill set you’re bringing to the table. And second, don’t ask….

- Telling your clients your process makes you look professional and it sets the expectation that your work will begin once the invoice is paid!!

- The beauty with using a tool like HoneyBook is that you can customize the breakdown of your payments based on how you like to bill your clients.

- Set installments based on dates.

- Set installments based on project milestones.

- Set monthly retainers with recurring payments.

- For jobs where you’re billing hourly, you can track your hours spent on a project and send an invoice. (We recommend sending your hourly invoice every 2 weeks until the end of the project!)

- No matter how you charge, it is important to be confident with your clients and collect a deposit upfront. By setting these expectations, your clients have buy-in on their project with you and will work within the parameters you’ve set for your work with them!

Accept online payments.

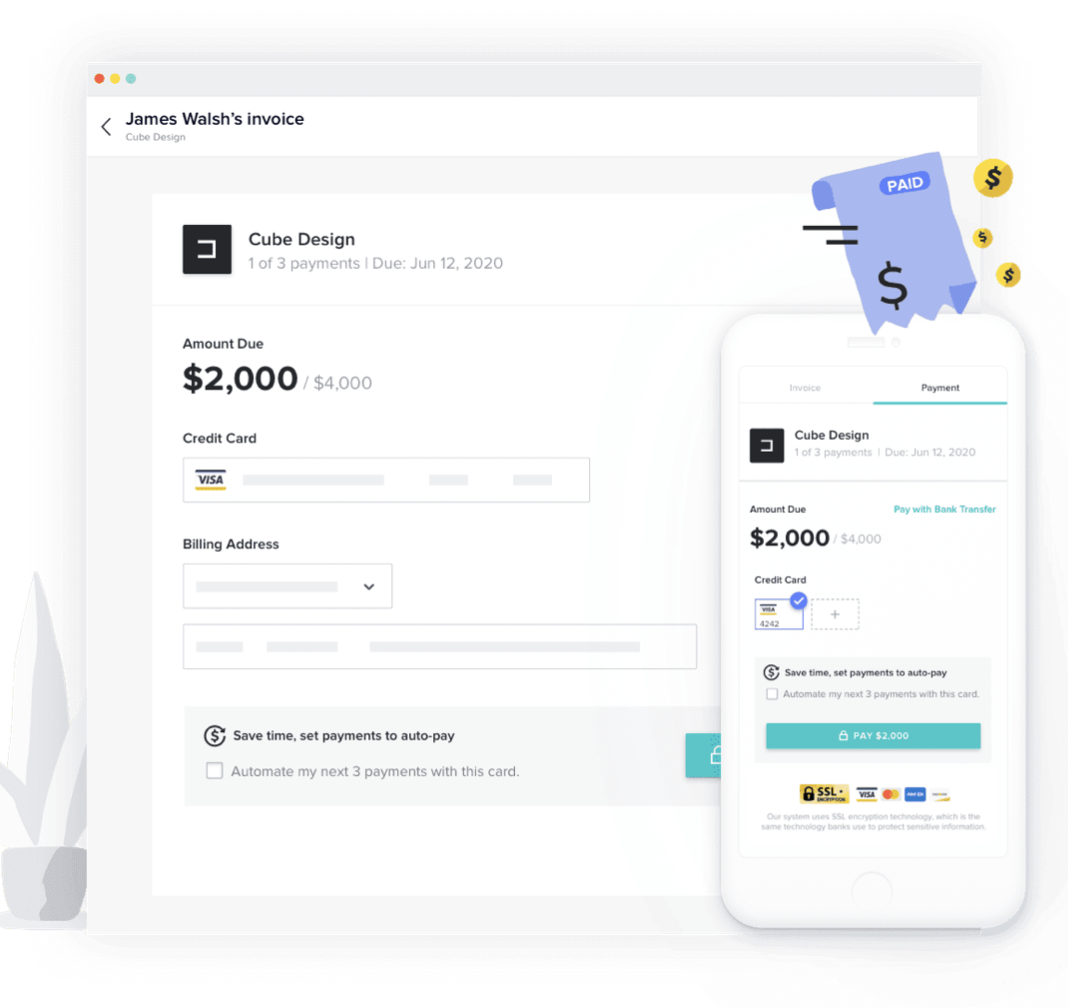

The best way to get paid is fast—for both you and your client. You, of course, want to get paid on time and your client wants the payment process to be as painless as possible.

HoneyBook has a processor already integrated in it’s platform so all you have to do is add your bank details in order to receive payment!

We talked about the importance of contracts and accepting deposits, and HoneyBook makes it so easy for clients to both sign your contract and make their payment in one place! Here’s how it works (all within HoneyBook!):

- Send an online proposal to your client

- Client can sign your contract electronically

- Then submit payment via credit card or bank transfer

- Cha-ching! You get paid.

HoneyBook online invoices provide a seamless client experience and get you paid—fast.

HoneyBook has all the same invoicing and payment capabilities as software like QuickBooks, but because HoneyBook is more than an accounting software, it has even more perks. You can manage all client communications in one place, automate repetitive tasks and get paid —all while keeping it personal and on-brand. (No separate invoicing tool needed!).

- A quick note on fees—All online payment processors take fees in order to cover the risk of processing a payment. The industry standard is right around 3%, which according to many experienced business owners, any normal business would jump at the chance to have such little transaction overhead. (Some say they charge way less in fees but this is often for in-person card swipes.)

HoneyBook charges the following rates per transaction:

- ACH bank transfer – 1.5%

- Card – 3%

Send reminders.

One of the most awkward conversations we would have was when we would need to remind our clients about payment! UGH!

HoneyBook makes payments easier for our clients (and less awkward for us!!)

- Even the best clients may need a nudge to pay on time. Because we’ve set up our client’s payment schedule in advance, HoneyBook will automatically send a payment reminder when a payment is coming up!

- This saves us time as we are not chasing after payments and don’t have to worry about annoying clients with constant reminders (just blame your software if you get any funny comments! LOL!)

- And they allow clients to pay from any device, wherever they are.

We know what you’re thinking….doesn’t that feel impersonal? Well, you can customize the email template for payment reminders. HoneyBook pre-sets the logistics, and you can add your personal touch to soften the emails if you’d like!!

Want to take it a step further? You can also set payments to automatically charge on their due dates! No reminders needed!!

So there you have it. Use these tips to make payments easy (for you and your clients) and get 50% off your first year of HoneyBook to make sure your business is set up to get paid quickly! 🔥

Get 50% off your first year here!

READ LATEST

the

MEET THE BLOGGERs

About

Husband & Wife. Creative Entrepreneurs. Photographers. Artists. World Travelers. Coaches. We’re here to take you along with us as we chase our wildest dreams, build big businesses that feed our souls, capture memories for epic humans, and see this beautiful world... together.

BRET & BRANDIE

Search

Journal

the

+ Show / Hide Comments

Share to: